Everyone knows that investment in property is ‘as safe as houses’. But of course getting on the property ladder these days is a total pipe dream; my 20yr old earns a decent salary, but accepts without question that house-owning is a far-off dream for his 30’s or 40’s. It’s simply not for him in the next decade at least.

So I was genuinely interested when UOWN got in touch to explain their system; which is so simple it borders on genius. It’s property crowdfunding – literally crowdfunding your house ownership.

By pooling your resources with thousands of UOWNers you could grab a piece of the property market and start making it work for you. But without the hideous black hole that is physical property purchase and mortgaging.

UOWN acts as a hub for people looking to invest in property crowdfunding. It’s a pretty straightforward concept; a group of people coming together to invest money into buying a property. Then, when the property is rented out, the investors all receive returns on the rent based on the amount they invested into the property.

See? I KNEW you’d be interested.

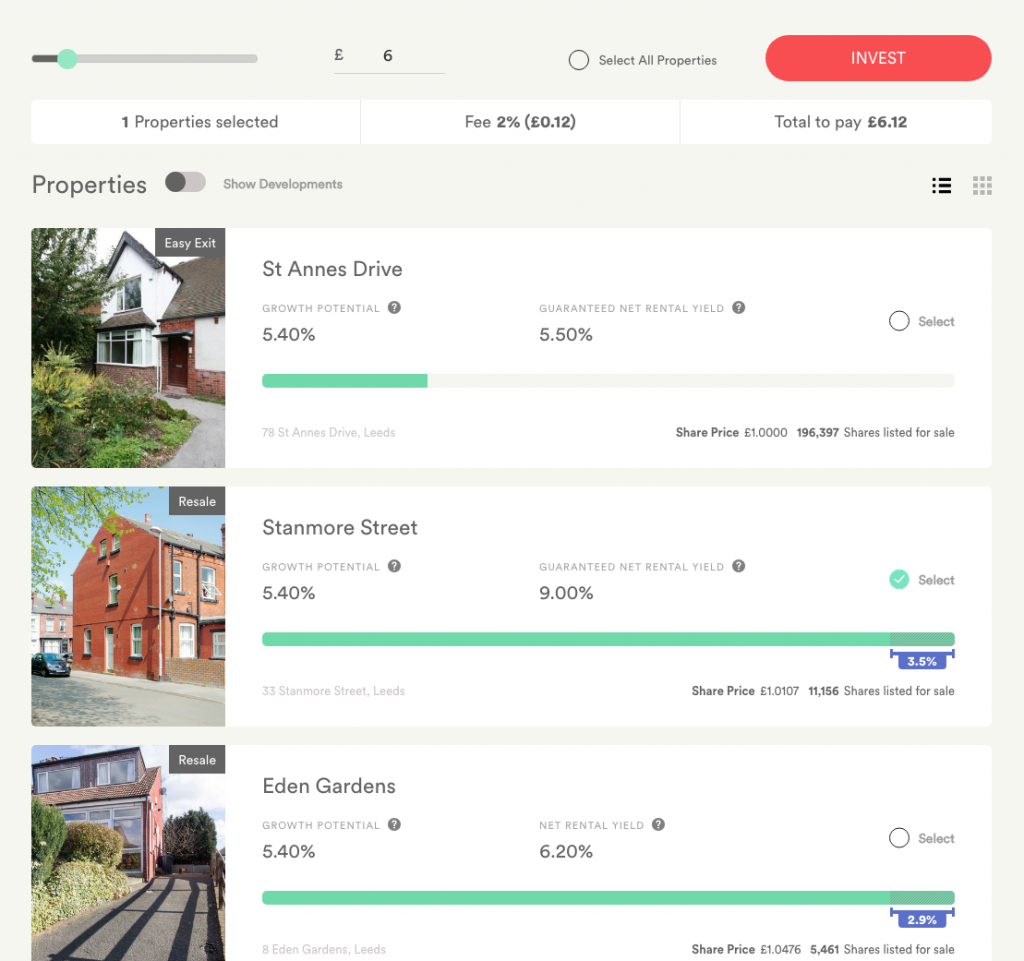

It is an investment – so obviously it can go down as well as up, there are no guarantees. But after a one-off fee of 2% to invest, over the 12 months to September 2018, the average total return after all fees and costs was 10%.

That’s a damned sight higher return than plopping your funds in a savings account.

And it’s totally accessible – you can invest from £1 to £100,000 and beyond, in one lump-sum or with manageable monthly payments.

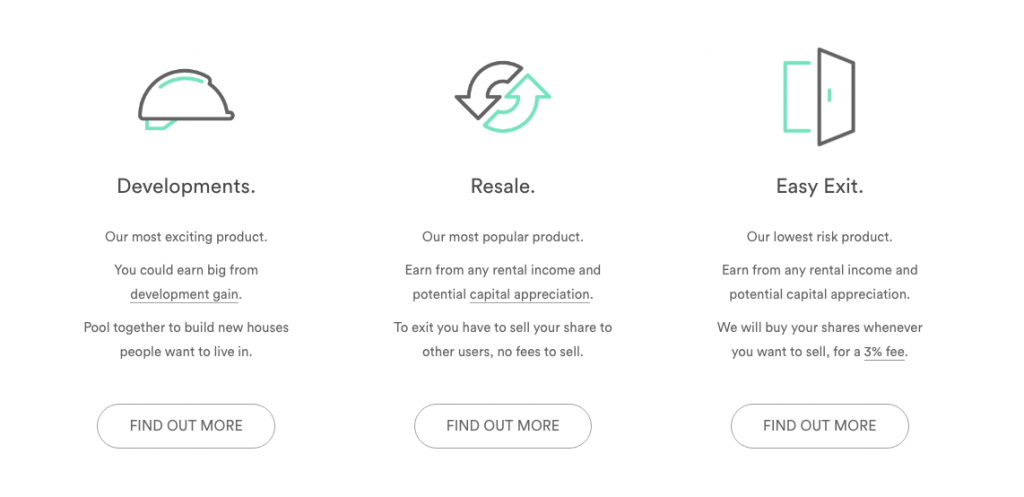

There are three Property Crowdfunding systems you can choose from:

Interested? UOWN seriously couldn’t make it any easier. Just click to the ‘invest’ page, select the house you want to invest in, and select the amount you’d like to invest;

Hit the big red button and you’re off and running!