Money Worries are something I think nearly all families face at some point in their lives. Sometimes it’s an unexpected bill that leaves things tight for a month. But sometimes it’s mind-numbing worry that keeps you awake at 3 in the morning, fighting the hot prickly feeling that steals across you over and over and over as you turn your problems around in your head, trying desperately to find a way out.

Thankfully, for most people, it’s a temporary thing. It may be afew months or even a couple of years, but we gradually claw our way back out of the debt pit, and vow to never ever look back.

But living in a mdoern society that’s not always easy..

And what do you do if, once you’re back on the right track, you find unexpected stumbling blocks in your path?

Family with her new car – image courtesy of Shutterstock

Let’s say you need a new car – very few people actually have the cash up front to pay for on, the norm these days is to purchase it on credit, and pay it off over the course of the next few years.

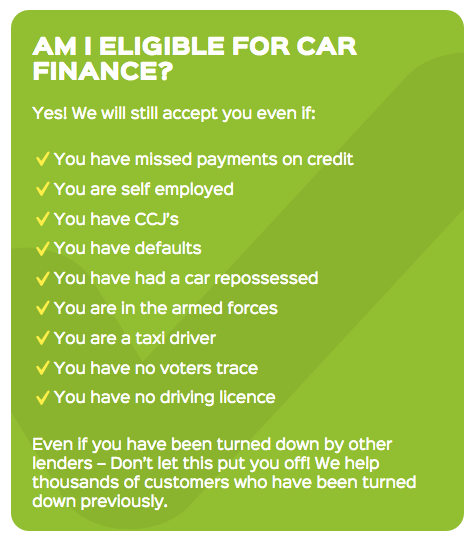

But you can’t GET credit if you have a poor history. No matter if you’re okay financially now, if you happen be self-employed, on a low income, have a CCJs, any payment defaults (I was 3 days late on ONE card payment once, and it messed my credit history up for a whole year), being in the armed forces, aren’t on the electoral roll… there are a whole host of reasons why lenders may not want to lend.

Thankfully it’s a problem that has been recognised, and there are a few firms who will help – and they’re not the TV loan sharks operating at 1789% APR, either. I was just looking at RefusedCarFinance, and there’s no scary rates – a typical APR is 32.9%. That’s high, obviously – but it’s not frankly horrifying like so many dodgy ‘easy loans’ you see advertised.

So if you’re struggling to get the credit for a new car, please don’t head for the dodgy end of the high street. Give Refused Car Finance a try – there’s loads of information so you can really understand how it all works, and then you can just see what they quote you.